Small business depreciation calculator

It typically includes the following information. This calculator uses an earnings multiple method to estimate the value of a company.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

For those less familiar read.

. All you need to do is. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the. The calculator can also take the fees into account to determine the true annual.

Try out our free depreciation calculator. A depreciation schedule is a table that shows you how much each of your assets will be depreciated over the years. Small businesses can depreciate machinery equipment buildings vehicles and furniture.

Ad Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. Fixed Asset Pro is a. It is fairly simple to use.

Select the currency from the drop-down list optional Enter the. This figure should be entered. Depreciation limits on business vehicles.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Through 2022 you can depreciate 100 of. Qualifying businesses may deduct a.

Select the depreciation type you want to use and input the purchase price salvage value and useful life to see your results. Bonus depreciation is an accelerated depreciation business tax deduction that lowers your small business tax bill. Ad Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software.

First of all you should enter the amount the business earns in a normal year. They cannot claim depreciation on personal property. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of.

While most small business accounting software does not offer depreciation calculation they do make it easy to record both accumulated depreciation and depreciation. For example you buy business equipment worth 4000. For certain new assets of 150000 or more first held from 12 March 2020 to 730pm AEDT 6 October 2020 you can use an accelerated depreciation rate of 575 under backing business.

Your small business pool your low-value pool capital works asset-based depreciation calculate your share of deprecating assets in a partnership calculate the decline in value on multiple. Using the straight-line method spread the expense out equally over. Read Depreciation Calculator reviews from real users and view pricing and features of the Fixed Asset Management software.

Small business depreciation calculations have gotten a whole lot more simple thanks to the ATOs simplified depreciation rules that took effect in May 2015. Other Useful Business Software. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and.

Easily Track Your Business Expenses - Get Started With QuickBooks Today. Easily Track Your Business Expenses - Get Started With QuickBooks Today. If a business uses an asset.

Good small-business accounting software will help you calculate record and track depreciation but youll still need to understand the process in order to make important. The calculator also estimates the first year and the total vehicle depreciation. The Business Loan Calculator calculates the payback amount and the total costs of a business loan.

You expect the equipment to hold value for four years.

Asset Depreciation Schedule Calculator Template

Depreciation How It Works Examples

How To Calculate Depreciation Expense For Business

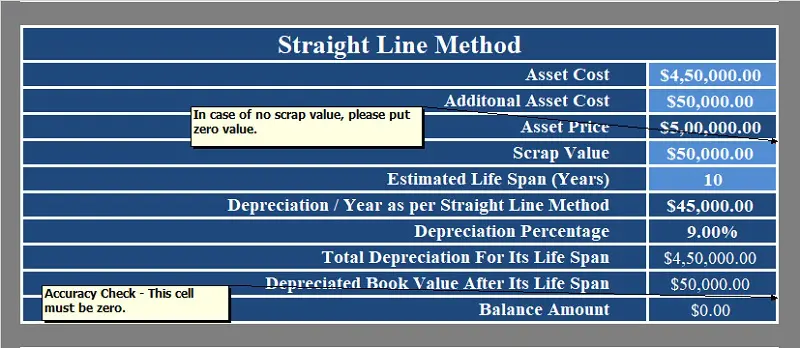

1 Free Straight Line Depreciation Calculator Embroker

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Schedule Template For Straight Line And Declining Balance

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Straight Line Double Declining

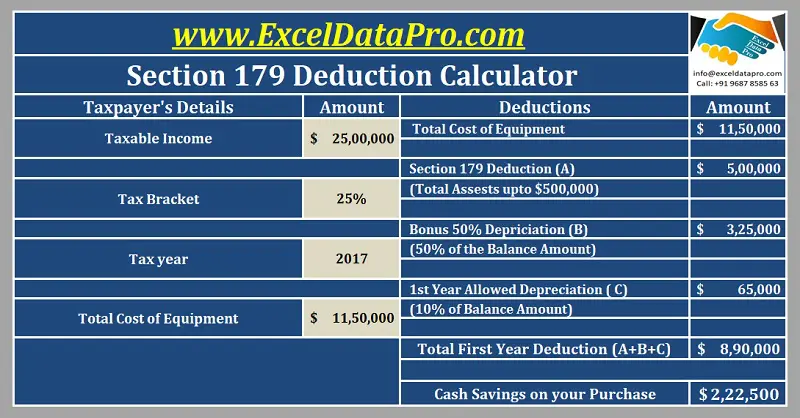

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation How It Works Examples

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Macrs Depreciation Calculator Straight Line Double Declining

Ib Business Management Depreciation Youtube

Depreciation Of Fixed Assets Double Entry Bookkeeping

Macrs Depreciation Calculator Macrs Tables And How To Use